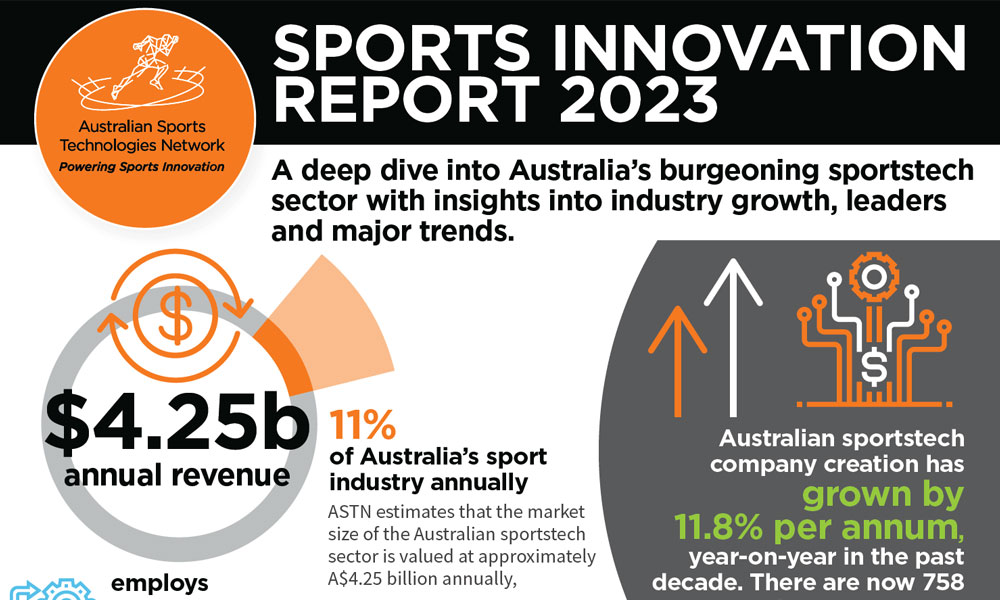

New report reveals Australia’s sportstech Sector is now worth A$4.25 billion

The Australian Sports Technologies Network (ASTN) has today released its annual Sports Innovation Report for 2023, revealing that Australia’s sportstech sector is now worth A$4.25 billion, equal in value to Australia’s fintech sector1.

As the peak body for sports technology and innovation, ASTN has developed a detailed market sizing and economic impact analysis on Australia’s sportstech industry. The 2023 report builds on the findings from ASTN’s inaugural report in 2022.

"Rapid growth in sportstech is reshaping the sports industry as we know it and unlocking new revenue streams. The second edition of the ASTN Sports Innovation Report takes a deeper dive into the emerging sector – to help inform industry leaders, and provide new growth opportunities for sportstech startups,” said Dr Martin Schlegel, Chair, ASTN.

ASTN has uncovered 758 companies that make up Australia’s sportstech ecosystem, now employing 13,438 people. Australian sportstech company creation has grown by 11.8% per annum in the 10 years since the inception of the ASTN in 2012, when there were only 284 companies.

The report identifies 115 companies as industry leaders. This list includes well-known Australian brands including 2XU, SWEAT, VULY and PTP. These companies generate around 87% of the total revenue of the industry.

“Australia’s sportstech sector has proved it has now moved out of its nascent stage as it goes head-to-head with Australia’s booming fintech sector. Australia continues to prove that it’s one of the world’s leaders and long-term pioneers in sports technology and innovation. The sector has exceeded all expectations in this year’s report as the sector surpasses A$4 billion in revenue,” said Dr Schlegel.

There has been exponential sportstech growth world-wide. The global sportstech industry is estimated to be worth US$22.9 billion in 2022, with it expected to grow by 13.8% per annum to US$41.8+ billion by 20272.

New wave of technology set to emerge ahead of Brisbane 2032 Olympics

Australia’s sportstech sector is predicted to continue its successful trajectory and sustained growth with a new wave of technologies emerging in preparation for the Brisbane 2032 Olympics and Paralympic Games.

“We are building one of the world’s most advanced and integrated sportstech ecosystems in the lead-up to several major events in Australia’s sporting calendar over the next decade. We can expect to see new technologies from AI, big data analytics to mobile, non-invasive wearable sensors and smart materials being deployed across the sportstech market verticals. As a result, new companies will be formed providing opportunity for further growth of the sector,” said Dr Schlegel.

On the pulse: 10 trends driving the sector

The report identifies 10 major themes that provide strategic opportunities for the industry derived from conversations with industry leaders, startup businesses and government.

“The 10 emerging sportstech themes we’ve identified – from ESG to smart apparel – have accelerated digital transformation across leagues, teams and federations globally in recent years. To continue the sector's momentum, Australia’s sportstech firms need to stay abreast of global trends and take advantage of these opportunities to reap the rewards over the next decade,” added Dr Schlegel.

Sportstech cluster identified on Australia’s eastern seaboard

The report identifies the formation of a rapidly growing sportstech cluster along Australia’s eastern seaboard with 90% of sportstech companies headquartered in VIC, NSW and QLD.

Victoria continues to lead the way as the backbone of Australia’s sportstech sector, with 41% of all sportstech companies based in Victoria. Dr Schlegel says there’s still tremendous opportunity for other states – representing only 10% of the industry – to ride the sportstech wave and get ahead of the curve in the lead-up to the 2032 Olympics.

“There’s still an enormous amount of untapped opportunity in the local sportstech ecosystem. Australia’s sportstech sector is manifesting its position as an ideal incubation and validation market with our global counterparts acknowledging the capability and quality of sportstech solutions derived here” said Dr Schlegel.

KEY REPORT FINDINGS:

- Sportstech employment by state: Of the 13,438 people employed in sportstech, ASTN estimates that nearly half (48%) of sportstech jobs are based in Victoria, followed by NSW (27%) and QLD (18%).

- Sportstech location: The majority of sportstech companies are based in Victoria (41%), New South Wales (31%) and Queensland (19%) – with a concentration of activity in the three key metro areas including Melbourne, Sydney and South East Queensland.

- M&A activity has slowed: There has been a decline in mergers and acquisition (M&A) and capital raising activities in FY23 compared to FY22 – due to significant tightening of access to investment capital, driven by rising interest rates and inflationary pressures. M&A activity has slowed to around A$500 million in FY23, compared to over A$1 billion in FY22.

- ASTN companies are paving the way: Sportstech companies mentored by ASTN programs now employ 270 people, and thirty of the 70-plus alumni startups from ASTN’s Accelerator program have raised a total of more than A$60 million in capital over the last few years.

- Mass Participation & Active Living market dominates: ASTN has found the majority of companies (56%) provide their products and solutions to the Mass Participation & Active Living market, followed by Business of Sport & Entertainment market (46%) and Professional & Elite Sport (14%).

- ICT continues to be the largest technology category: The majority of companies develop their solutions using Information and Communication Technologies (ICT) (66%), followed by Advanced Materials (23%) to build their products.

- Emerging sportstech trends present new opportunities: ASTN's top 10 themes include 1. Artificial Intelligence (AI), 2. Active Living, Fitness and Wellness, 3. Web 3.0, Metaverse, Gaming and Blockchain, 4. Virtual Sports of Tomorrow 5. Smart Apparel, Equipment and Wearables 6. ESG, 7. Sports Digital Ethics, Privacy and Security 8. Women in Sportstech, 9. Investment and Venture Capital, 10. Global Trade and Business Matching.

“We look forward to working closely with our robust network of start-ups, scale-ups, established sportstech companies, government and the wider sports community – to take Australia’s sportstech sector to its next phase of growth by providing leadership in the development and commercialisation of new products and innovations at the intersection of sports and technology,” said Dr Schlegel.

The report was officially launched at ASTN’s member event on Wednesday 24 May 2023 at its headquarters in Cremorne, Victoria.

Download the full Sports Innovation Report 2023.

Download Sports Innovation Report 2023 Infographic.

About Australian Sports Technologies Network (ASTN)

Australian Sports Technologies Network (ASTN) provides leadership in the commercialisation, development, and promotion of Australian-inspired Sports Technologies. Established in 2012, ASTN is today a world-leading pioneer with over 500 organisations in its national network across the landscape of Sports Digital, Sports Research, Stadium/Venues, Media, Entertainment, eSports, Human Performance, Fan Engagement, Sports Data, Artificial Intelligence in Sports, Sports Equipment, Sports Smart Apparel and Sports Universities.

In September 2021 it was announced that Australian Sports Technologies Network (ASTN) would establish, operate and manage the first Australian Sports Innovation Centre of Excellence (ASICE) located adjacent to Melbourne Olympic Park in the Victorian flagship Digital Hub of Cremorne from 2022-2026. ASTN with the support of the Victorian Government bundles its accelerator, masterclass, and sports tech operations into a physical hub location for the 21st century.

For more information, please visit www.astn.com.au.