Australia’s Sportstech Sector Builds Global Traction Through Increased Innovation and M&A

The Fourth Edition of ASTN’s annual report provides a comprehensive census of Australia’s sports innovation sector. Driven by consistent gains in both revenue and employment, Australia’s sportstech sector continues to prosper. In FY2025, the sector sustained its momentum with 10% growth, matching the pace of FY2024. Revenue climbed to A$5.65 billion, while total employment reached 17,928 – highlighting an increasingly resilient and stable sector.

This new era of mature growth is marked by a plateau in year-on-year growth in the number of companies, the mainstream adoption of technology across all levels of sport, increased industry consolidation, and a growing number of category leaders that are securing strong market positions, as well as consistent revenue growth.

“What started as a disjointed industry in a country with a strong sports pedigree in 2012, has developed into one of the top six sportstech clusters globally over the past decade. Australia’s sportstech sector now stands at the forefront of sports innovation, driven by world-class startup talent and technology developments,” said Dr Martin Schlegel, Chair, Australian Sports Technologies Network (ASTN).

Aussie sportstech M&A and capital raising awaken from slumber

The report shows that in FY2025, Australia experienced its most active sportstech mergers and acquisitions, and capital raising period since FY2021. There were 27 significant transactions in FY2025, compared to 14 in FY2024.

“As perceived sector risk declines, we’ve seen increased interest from sophisticated investors. We’re finding that the rise of sports as an asset class for sophisticated investors is bringing more attention to the sportstech sector both domestically and globally. Many large private equity players are starting to invest heavily in sports teams and leagues, with sportstech companies benefiting as a result,” added Dr Schlegel.

Consolidation highlights resilience as sportstech sector holds steady post-COVID

ASTN estimates that Australia’s sportstech sector now consists of 840 companies, representing a similar number to FY2021. The growth of 119 new companies over the last four years has been entirely offset by businesses that have ceased operations.

"The report highlights the local sportstech sector’s ability to adapt and grow, with a consistent increase in revenue and employment despite challenging times. This proves that the local sportstech ecosystem is increasingly stable, with a solid foundation for future growth and potential," added Dr Schlegel.

Revenue and employment growth led by high growth companies

Research shows that industry revenue and employment growth are being driven by a portfolio of high growth companies that, as category leaders, are succeeding not only domestically but also on the global stage. ASTN estimates that the top 115 companies (15%) in the sportstech sector contribute approximately A$4.84 billion revenue per annum, or 86% of the total revenue generated.

“Growth in economic value and employment are now driven by a range of fast-scaling businesses like Catapult, VALD and Rosterfy. These companies have emerged as international leaders in their respective categories, cementing the notion that Australia’s sportstech sector continues to punch well above its weight globally,” added Dr Schlegel.

Australia strengthens global positioning, but local investment lags behind

The report highlights that the US dominates sportstech venture capital activity, while Europe leads clusters and startup programs. Despite emerging markets of Asia and MENA, the US and Western Europe still account for the majority of global sportstech activity.

While the APAC region currently accounts for only around 10% of global sportstech activity, Australia's reputation as an innovation hub is gaining international traction. Australian startups are increasingly expanding into global markets and securing overseas investment. The United States, United Kingdom and Western Europe continue to be the three priority international markets for Australian sportstech companies.

While M&A and venture capital activity has accelerated in FY2025, Dr Schlegel says that domestic corporate engagement and R&D investment continues to fall short. “Despite Australia being globally recognised as one of the leading sportstech innovation clusters in the world, corporate engagement, research and development investment continues to fall short,” said Dr Schlegel.

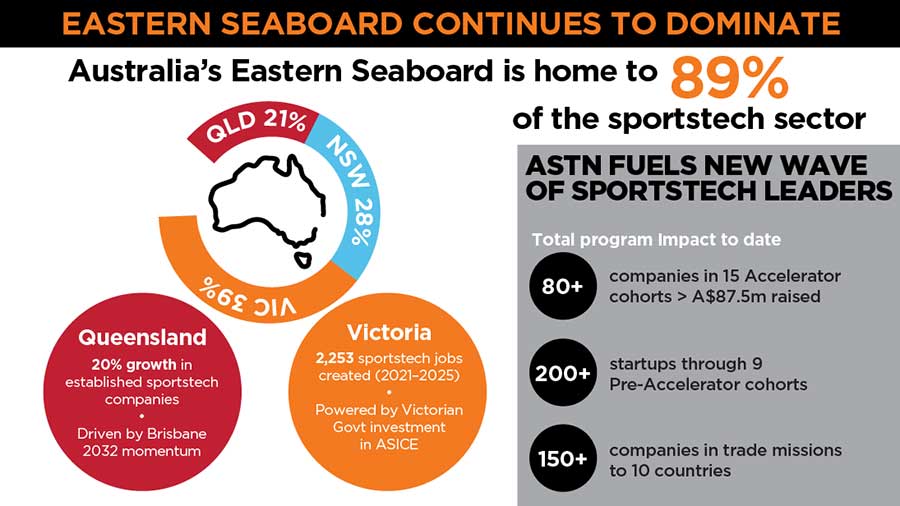

Eastern Seaboard continues to drive sportstech growth, with QLD on the rise

Australia has continued to develop a sportstech cluster along the Eastern Seaboard which represents 89% of the total sportstech sector. The majority of established sportstech businesses are headquartered in Victoria (39%), followed by New South Wales (28%) and Queensland (21%).

Queensland surpasses the growth of any other state, with a 20% increase in established companies for FY2025. “With major event and infrastructure investment in lead up to Brisbane 2032, we’ve seen a notable spike in sportstech activity. ASTN believes that Queensland’s sportstech economy could surpass that of New South Wales within three to four years based on current trends,” said Dr Schlegel.

KEY 2025 REPORT FINDINGS:

- New era of growth: The sector has settled into a stable, increasingly mature stage of its lifecycle, marked by a plateau in year-on-year growth in the number of companies, and consistent revenue growth.

- Market value: The sportstech sector is now worth A$5.65 billion annually, maintaining a consistent 10% increase over the past 12 months. This figure represents 11-13% of the total sports industry.

- Company closures and startups: Australia’s sportstech sector now has 840 companies (similar number to FY2021) – with 119 new companies over a four-year period, revealing sector stability despite numerous challenges.

- Increased M&A and capital raising: Australia experienced its most active sportstech M&A and capital raising period since FY2021. There were 27 significant transactions in FY2025, compared to 14 in FY2024.

- US Dominates VC, while Western Europe leads industry clustering: The US dominates venture capital, with 66% of the world’s 151 sportstech investors. Europe leads industry development, hosting 63% of active clusters and half of global startup programs.

- Market leaders: The top 15% of companies continue to generate 86% of the sector’s revenue.

- Eastern seaboard dominance: 89% of the industry is located along the Eastern Seaboard, with Victoria leading in sportstech activity (39%), followed by New South Wales (28%) and Queensland (21%).

- QLD is set to overtake NSW: Queensland’s sportstech sector grew 20% to 178 companies in FY2025, with ASTN predicting it could overtake NSW within the next four years.

- 2,253 jobs created in Victoria’s sportstech boom: A landmark four-year partnership between the Victorian Government and ASTN to establish the Australian Sports Innovation Centre for Excellence (ASICE) has helped to create 2,253 jobs across Victoria’s sportstech sector.

- Sportstech expands into adjacent industries: ASTN is seeing growing tech transfer between sportstech and adjacent industries, with sports often used to test and validate innovation. Currently, 22% of sportstech businesses serve adjacent markets—a figure expected to rise as convergence continues.

- Sportstech still lagging with gender diversity: Women founders only represent 9% of the sportstech sector. Through targeted women in sportstech initiatives, ASTN has a goal for at least 15% of sportstech firms to be women led or co-founded within the next five years. The research also reveals that only 5% of founders are current elite or former athletes.

- Future sportstech trends: Artificial intelligence in sport, esports and international trade are some of the key themes that are expected to drive future growth in the sportstech sector in coming years.

- ASTN fuels a new wave of growth leaders: 80+ companies across 15 cohorts of Accelerator programs, have raised A$87.5 million. 200+ startups across nine cohorts of Pre-Accelerator programs. 150+ companies in trade delegation to 10 countries.

“As part of ASTN’s commitment to supporting industry growth and innovation for the sector, we continue to monitor key trends and their relevance and impact on the business of sport. We’ve noticed that themes like AI in sport, esports, international trade, smart stadium tech and women-led innovation are going to be more prevalent over the next few years. We look forward to working closely with our network to ensure Australia’s sportstech sector is not only capitalising on these trends but also leading the way in innovation,” said Amy Crosland, Chief Operating Officer, ASTN.

The report will be officially launched at ASTN’s member event at Swanston Hall, Melbourne Town Hall on Thursday, 29 May 2025 – which is supported by the City of Melbourne. This will be attended by the Hon. Danny Pearson – Minister for Economic Growth and Jobs, Minister for Finance and other key industry leaders.

Quotes attributable to City of Melbourne portfolio head for Innovation and Education, Andrew Rowse

"Melbourne is truly the sporting capital of the world, from Marn Grook to the MCG to Melbourne Park - sport is the religion that binds us together as a city, so it's no surprise that almost 40 per cent of sports tech companies in Australia come from Victoria."

"Melbourne has all the ingredients for a thriving startup community, great Universities, world class talent and an underdog attitude to take our innovations to the world. With strong ambition and support, we’re growing into a global powerhouse when it comes to sports tech."

ENDS

For more information about the report, or to speak to an ASTN spokesperson, please contact ASTN’s Communications Manager, Tara Ballard, at tara.ballard@astn.com.au

About ASTN: The Australian Sports Technologies Network (ASTN) is a leading organisation dedicated to the development and promotion of the sportstech industry in Australia. The ASTN Sports Innovation Report is a comprehensive analysis of the trends, growth, and advancements within the sector.